This blog post explains how Wise – Commission payout currency USD makes international payments simpler, faster, and more transparent for businesses, freelancers, and global platforms. It highlights how using USD as a standard payout currency through Wise reduces hidden fees, minimizes currency conversion hassles, and ensures smooth cross-border commission payments worldwide.

Table of Contents

- Introduction: Why International Payments Still Feel Complicated

- Understanding Wise and Its Global Payment Vision

- What Does “Commission Payout Currency USD” Mean?

- The Challenges of Multi-Currency International Payments

- How Wise’s USD Commission Payout Solves These Problems

- Benefits for Businesses Using Wise USD Payouts

- Benefits for Freelancers, Affiliates, and Remote Workers

- Wise USD Payouts vs Traditional Bank Transfers

- Wise USD Payouts for Digital Platforms and Marketplaces

- Compliance, Security, and Trust

- Real-World Use Cases of Wise USD Commission Payouts

- Getting Started with Wise USD Commission Payouts

- Common Myths About USD International Payouts

- The Future of International Payments with Wise

- Conclusion: Why Wise USD Commission Payouts Are a Smart Choice

- Frequently Asked Questions (FAQs)

Introduction: Why International Payments Still Feel Complicated

Let’s be honest—international payments can feel like navigating a maze blindfolded. Hidden fees, confusing exchange rates, delayed settlements, and currency mismatches often turn a simple payout into a stressful experience. Whether you’re a freelancer, affiliate marketer, SaaS business, or global enterprise, getting paid across borders shouldn’t feel this hard.

This is where Wise – Commission Payout Currency USD changes the game. By simplifying cross-border transactions and using USD as a universal payout currency, Wise helps businesses and individuals move money globally with clarity, speed, and confidence.

In this article, we’ll break down exactly how Wise’s USD commission payout system simplifies international payments, why it matters, and how you can benefit from it—without drowning in jargon.

Understanding Wise and Its Global Payment Vision

What Is Wise and Why Is It Trusted Worldwide?

Wise is a global financial technology company built to make international money transfers transparent, fast, and affordable. Formerly known as TransferWise, the platform has earned trust by doing one radical thing: showing users the real exchange rate without hidden markups.

Wise operates in multiple countries, supports dozens of currencies, and serves freelancers, remote workers, online platforms, and multinational companies alike.

The Mission Behind Wise’s Payment Infrastructure

Wise’s mission is simple but powerful—money without borders. Their systems are designed to remove friction, reduce costs, and give users full visibility into how their money moves. Using USD for commission payouts is a strategic extension of that mission.

What Does “Commission Payout Currency USD” Mean?

Breaking Down the Concept in Simple Terms

A commission payout in USD means that payments—such as affiliate commissions, partner earnings, or global salaries—are issued in US Dollars, regardless of where the recipient is located.

Instead of juggling multiple local currencies, businesses standardize payouts in USD. Recipients can then convert or withdraw funds locally using Wise.

Why USD Is the Global Payment Standard

USD is the world’s most widely accepted currency. It’s stable, liquid, and recognized across borders. Think of it as the “common language” of global finance—everyone understands it, and almost every bank supports it.

The Challenges of Multi-Currency International Payments

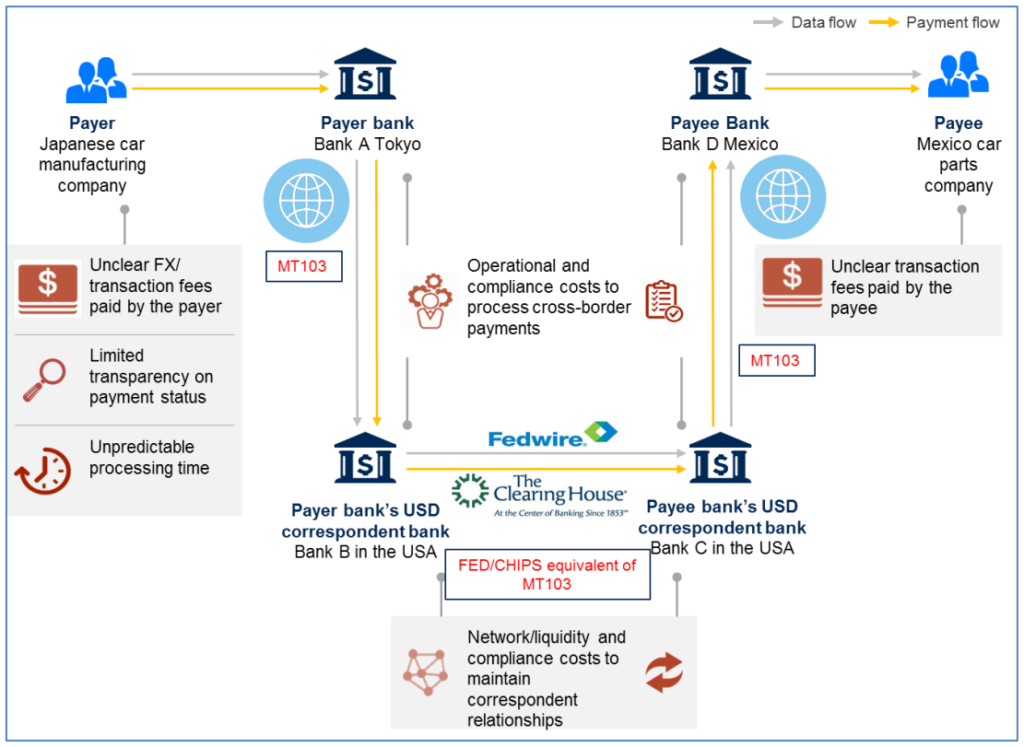

Hidden Fees and Exchange Rate Markups

Traditional banks often advertise “low transfer fees” but quietly inflate exchange rates. Over time, these hidden costs eat into earnings—especially for commission-based payouts.

Payment Delays and Compliance Issues

Multiple currencies mean multiple banking systems, compliance checks, and processing delays. Payments can take days—or even weeks—to settle.

Accounting and Reconciliation Nightmares

Tracking payments across currencies complicates bookkeeping, tax reporting, and financial forecasting.

How Wise’s USD Commission Payout Solves These Problems

One Currency, One Clear System

By standardizing commission payouts in USD, Wise removes currency confusion. Businesses send payments once, and recipients receive funds without unnecessary conversions along the way.

Real Exchange Rate Transparency

Wise uses the mid-market exchange rate, the same rate you see on Google or Reuters. No padding. No surprises.

Lower Overall Costs

Fewer conversions mean fewer fees. That alone can save businesses and freelancers hundreds—or thousands—over time.

Benefits for Businesses Using Wise USD Payouts

Simplified Global Payroll and Affiliate Payments

Whether you’re paying 10 partners or 10,000 affiliates, USD payouts streamline operations. No more managing currency-specific payout rules.

Predictable Cash Flow

When payouts are standardized in USD, forecasting becomes easier. Finance teams love predictability.

Faster Settlement Times

Wise processes payments quickly by using local banking networks behind the scenes, even when the payout currency is USD.

Benefits for Freelancers, Affiliates, and Remote Workers

Get Paid Like a Global Professional

Receiving commissions in USD instantly boosts credibility. Many international clients prefer paying in USD—it feels universal and reliable.

Easy Local Withdrawals

Wise allows users to convert USD into local currency at fair rates and withdraw directly to their bank accounts.

Hold, Convert, or Spend USD Freely

With Wise, you can hold USD, convert it later when rates are favorable, or spend it using Wise’s debit card.

Wise USD Payouts vs Traditional Bank Transfers

Cost Comparison

Traditional banks often charge:

- High transfer fees

- Poor exchange rates

- Additional intermediary fees

Wise offers:

- Transparent fees

- Real exchange rates

- No hidden charges

Speed and Reliability

Bank transfers can feel like sending money by snail mail. Wise operates more like instant messaging—fast, trackable, and efficient.

Wise USD Payouts for Digital Platforms and Marketplaces

Perfect for Affiliate and Creator Economies

Platforms paying global creators, influencers, or affiliates benefit hugely from USD payouts. One currency. One workflow.

Scales Easily Across Borders

As platforms grow internationally, Wise grows with them—no need to redesign payment systems country by country.

Compliance, Security, and Trust

Is Wise Safe for International Payments?

Yes. Wise is regulated in multiple jurisdictions and uses advanced encryption and compliance protocols.

Built for Global Regulations

Using USD simplifies compliance since many international regulations already align with USD-based reporting.

Latest Post

Real-World Use Cases of Wise USD Commission Payouts

Affiliate Marketers

Get paid monthly commissions in USD, convert locally, and avoid platform-specific payout restrictions.

SaaS Companies

Pay global partners and resellers without building complex currency systems.

Freelancers and Consultants

Invoice in USD, get paid via Wise, and control when and how you convert your earnings.

Getting Started with Wise USD Commission Payouts

Setting Up a Wise Account

The signup process is simple, online, and fast. Identity verification is straightforward.

Adding USD Balance Details

Once verified, you receive USD account details that work like a local US bank account.

Receiving and Managing Payments

Track incoming commissions, convert currencies, and withdraw funds—all from one dashboard.

Read More:-

Unbounce: How High-Converting Landing Pages Drive More Leads in 2026

AirAsia Travel Platform: Features, Benefits, and Services

How Wrike Improves Project Management for Marketing Teams

Pipedrive for Marketing and Sales Alignment: A Complete Guide

Why Bolt Business Is Ideal for Business Transportation Needs

Common Myths About USD International Payouts

“USD Payouts Are Only for Big Companies”

Not true. Wise makes USD payouts accessible to individuals and small businesses too.

“I’ll Lose Money on Conversions”

With Wise’s real exchange rate model, you often save money compared to banks.

The Future of International Payments with Wise

Fewer Borders, More Control

USD commission payouts are just one step toward frictionless global finance.

Empowering the Global Workforce

As remote work and global platforms grow, Wise’s USD payout system fits perfectly into the future of work.

Conclusion: Why Wise USD Commission Payouts Are a Smart Choice

International payments don’t have to be complicated, expensive, or slow. Wise – Commission Payout Currency USD simplifies the entire process by combining transparency, speed, and global accessibility into one powerful system. For businesses, it means efficiency and predictability. For individuals, it means fair pay and financial freedom.

In a world that’s increasingly borderless, Wise proves that money should move just as freely.

Frequently Asked Questions (FAQs)

Q. Why does Wise use USD for commission payouts?

A. USD is globally accepted, stable, and simplifies cross-border transactions for both senders and recipients.

Q. Can I convert my USD payout to my local currency?

A. Yes. Wise allows instant conversion at real exchange rates with low fees.

QIs Wise cheaper than traditional banks for USD payouts?

A. In most cases, yes. Wise avoids hidden exchange markups and intermediary fees.

Q. Who benefits most from Wise USD commission payouts?

A. Freelancers, affiliates, digital platforms, SaaS companies, and global businesses.

Q. Is Wise safe for receiving international payments?

A. Absolutely. Wise is regulated globally and uses strong security and compliance measures.